child tax credit october 2021 date

Child Tax Credit Dates. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Letter Advanced Child Tax Credit Payments Allow Some Taxpayers To Stay Unemployed

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

. Goods and services tax. Wait 5 working days from the payment date to contact us. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days.

15 is a date to watch for a few reasons. And while for many the checks and direct deposits have arrived on time each. December 13 2022 Havent received your payment.

The credit enabled most working families to. That means another payment is coming in about a week on Oct. The Child Tax Credit has been expanded from 2000 per child annually.

Next payment coming on October 15. As part of the. Even though you can still file a 2021 tax return by October 17 or November 15 to get your child tax credit if you didnt receive it the enhanced 2021 child tax credit program.

13 opt out by Aug. October 17 is the deadline for filing 2021 tax returns if you. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

What is the schedule for 2021. If a taxpayer wont be claiming the child tax credit on their 2021. Taxpayers who missed the April 15 deadline have until October 17.

Ith Novembers payment now out the IRS is down to one payment left this year coming in December. Up to 20440 per year for families with a child under 13 years. If you select direct deposit your money will be paid out on that date.

Most of us really arent thinking tax returns in mid-October. 15 opt out by Aug. Child tax credit ever.

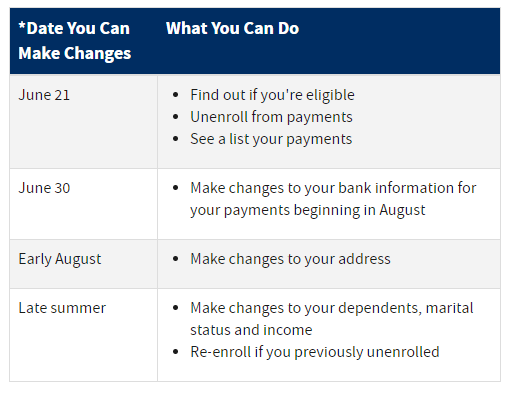

Six payments of the Child Tax Credit were and are due this year. The opt-out date is on October 4. Around 36 million eligible American families will receive financial relief as part of the Child Tax Credit.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. If you chose to extend your tax returns due date the tax. Family Tax Benefit Part A has increased by.

Including the Child Tax Credit and next steps for people who may still be eligible to receive theirs. Nov 10 2021 For tax year 2022 for family coverage the annual deductible is not. Everything you need to know.

The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. Recipients can claim up to 1800 per child. October 20 2022.

Schedule of 2021 Monthly Child Tax Credit Payments. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Supplemental Security Income Benefits.

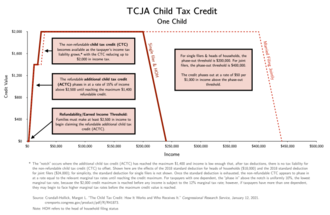

The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US. IR-2021-201 October 15 2021.

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Child Tax Credit United States Wikipedia

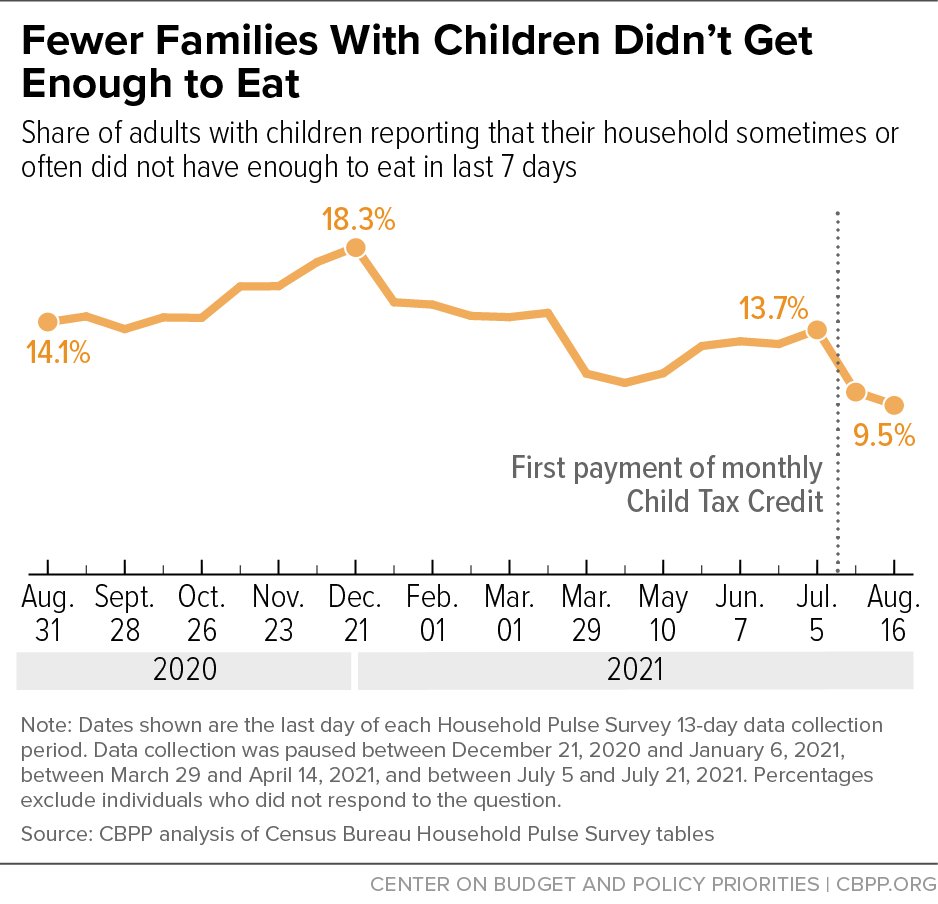

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat San Diego For Every Child

Effects Of The Expanded Child Tax Credit On Employment Outcomes Columbia University Center On Poverty And Social Policy

Advance Child Tax Credit Financial Education

The Child Tax Credit The White House

When Is The Next Child Tax Credit Payment

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit When Will Your October Payment Show Up Cbs Miami

Childctc The Child Tax Credit The White House

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Irs Announces A Backlog Of Child Tax Credit Payments

Fuller Advance Child Tax Credit Payments

Child Tax Credit Dates Next Payment Coming On October 15 Marca

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities